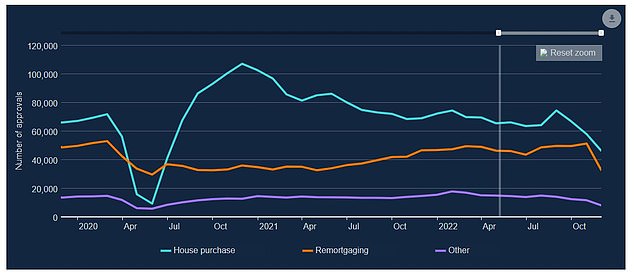

Mortgage approvals fell by a fifth in November to the lowest figure since June 2020, as buyers reconsidered house purchases

- Mortgage approvals fell to 46,075 in November from 57,875 in October

- Experts say slowdown is due to buyers ‘taking stock’ of market amid rising rates

- Mortgage product choice is down 32% compared to last January

Mortgage approvals fell by a fifth from October to November last year as prospective buyers paused to ‘take stock’ amid the cost of living crisis and high mortgage rates.

There were around 46,075 mortgage approvals in November the lowest number since June 2020, according to the latest data from the Bank of England.

This is down from 57,875 in October and 68,969 in November 2021 – a 33 per cent fall year-on-year.

Mortgage approvals and remortgage approvals have fell month-on-month in November

Commenting on the figures Gareth Lewis, commercial director of property lender MT Finance, said: ‘These figures clearly show the squeeze consumers are facing.

‘Purchase approvals are down, showing that many people stopped and took stock in November as rates continued rising, wondering how high they were going to go and whether they could afford the purchase they were considering.

‘Those who aren’t forced into a move may well be wondering whether they should put that purchase on hold for now and wait until the outlook becomes clearer.’

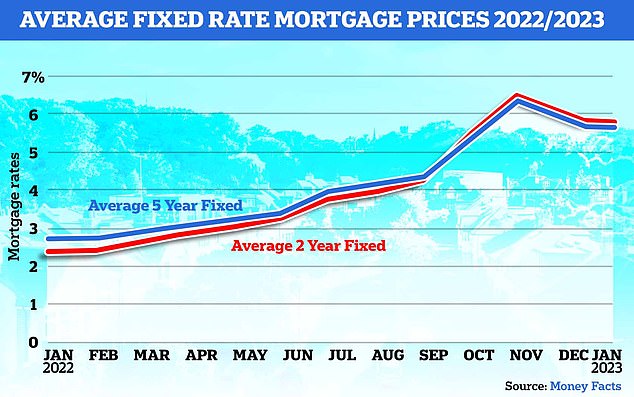

Tom Bill, head of UK residential research at Knight Frank, added: ‘Rates are edging back down but are still several percentage points higher than they were this time last year.

‘Price declines will become more widespread and sales volumes will come under pressure later this year as more buyers recalculate their financial position but the downwards trajectory will be more gentle than anything seen in the chaotic final quarter of 2022.’

Bank of England data shows how quickly mortgage approvals have fallen since late summer

For those needing a mortgage, the increase in cost over the past few months has been significant.

First-time buyers may find that getting approved for a mortgage is more difficult, as higher interest rates combine with the cost-of-living crisis and higher rents to putting additional pressure on household finances.

Currently the average two-year fixed rate mortgage across all LTVs is 5.78 per cent and with the average five-year fix at 5.62 per cent. A year ago they were 2.65 per cent and 2.88 per cent, respectively.

>> Compare rates and find the best mortgage for you with This is Money’s tool

Mortgage rates rose rapidly last year in the wake of the disastrous ‘mini-Budget’ in September

The rapid rise in rates has also had an impact on those looking to remortgage. Remortgaging approvals fell 37 per cent in November compared to the previous month, and down 30 per cent compared to November 2021.

Half of UK homeowners are on a fixed rate mortgage ending within the next two years. While rates are now falling from their Autumn highs, many of these borrowers are still likely to see their monthly payments rise significantly - at a time when incomes are already stretched.

At the same time the number of mortgage products available to borrowers has fallen by nearly a third compared to the same time last year.

Currently there are 3,654 residential mortgage products on the market across all loan to value ratios, down 32 per cent from the same date last year according to data from Moneyfacts.

Anil Mistry, director and mortgage broker at RNR Mortgage Solutions, said some lenders had removed their 5 per cent deposit mortgages as they expected house prices to fall and wanted to avoid the risk of negative equity.

At the same time First Direct has launched a range of best-buy fixed rate mortgage deals with loans for first time buyers, movers and those looking to remortgage.

The new range includes reduced rate loans at 60 and 75 per cent loan to value ratios at 4.29 per cent to 5.19 per cent.

Advertisement