Few parents would be suspicious of a text message from their son or daughter saying they had broken their phone and was using a temporary number. Especially, perhaps, if it was signed with their name, kisses and even a love heart emoji.

But many families have found the seemingly innocent message is, in fact, the start of a cynical scam that can leave them thousands of pounds out of pocket.

Known as the ‘mum and dad’ or ‘friend in need’ con, fraudsters impersonate their victims’ loved ones via the text messaging service WhatsApp.

Ex-headmistress Elizabeth Baker - who lives with retired church minister Hugh (pictured) - came close to losing more than £500 after a scammer pretended to be her daughter

They claim to be in distress and in urgent need of cash in the hope worried relatives will hand over money without thinking twice.

Santander reported a 532 per cent surge in the new scam between August and November last year.

Nearly two-thirds of the crooks were impersonating someone’s son, while 33 per cent pretended to be their daughter.

Data from Action Fraud reveals victims lost nearly £50,000 between August and October last year; some victims are out of pocket by up to £3,000 each, says the fraud reporting body.

One family, which wishes to remain anonymous, was tricked out of £1,500.

Scammers contacted the father posing as his daughter, claiming she had visited a private clinic for emergency medical treatment and that a doctor was pestering her to settle the bill.

Over the course of two days, the fraudsters sent a total of 56 messages asking for help, until her worried father asked her grandparents to send the money.

It was only when the family finally reached her on the phone the following day that they realised he had been duped.

A conman tricked Cally Beaton’s father out of £1,800

The grandfather, 75, says: ‘My granddaughter has a very unusual spelling of her name. So when the text came up, we didn’t think for a second it could be anybody else.

‘My son rang me in a panic saying she desperately needed the money, so we said we’d make the transfer.

‘Once you realise it’s a scam, you feel like a fool. It’s horrible.’

His bank has since refunded the money.

Elizabeth Baker, 70, came close to losing more than £500 after a scammer pretended to be her daughter Katrina.

The grandmother-of-three was on holiday in Eastbourne when she received a WhatsApp message.

‘Hi Mum, I dropped my phone down the toilet, so I can’t use it anymore,’ it read.

At first the retired prep school head advised her to pop her phone into a box of rice to dry it out, but then the scammer began asking her for cash.

Elizabeth says: ‘The message said it was for an urgent bill which needed to be paid by tomorrow and sent me the bank details to transfer the money.’

She became suspicious and rang Katrina’s partner, who confirmed that her daughter’s phone was fine.

Elizabeth, who lives with retired church minister Hugh, in Tamworth, Staffordshire, says: ‘Those messages could easily have come from my daughter. It just shows how all of us are vulnerable to these scams.’

That vulnerability, heightened by the pandemic, almost caught out Cally Beaton’s father: he nearly lost £1,800 to a WhatsApp scammer pretending to be one of his children.

The retired teacher, who did not want to be named, received a message addressing him as ‘Dad’ last week. The sender claimed they were contacting him from a new number after breaking their old phone.

Cally, 52, says: ‘They signed the message off with an ‘x’ and my father assumed it was my brother. It was so sad, because he was really pleased to hear from my brother and was asking how he was.’

The scammer then told her dad they had not checked their email for a while and needed to borrow £1,800 to pay a bill.

However, when Cally’s father tried to transfer the money through his online account, the bank halted the payment and requested a call to authorise it.

Luckily, the pensioner went on to call Cally before he did anything else, and she told her father it was a scam. Cally, a comedian from Camden, North London, says: ‘I was furious to think that people would exploit parents who just wanted to talk to their children during the pandemic.’

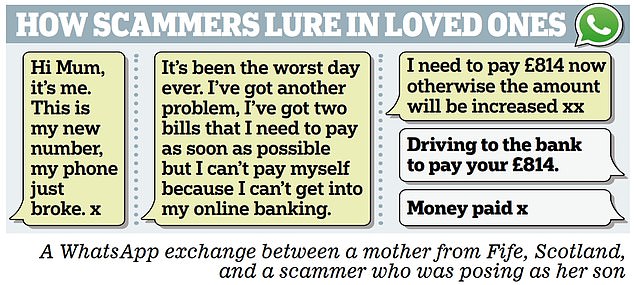

Money Mail also spoke to a woman, 66, who paid £814 to a scammer posing as her son. She says he had been struggling financially due to the pandemic — which made the requests for money all the more believable.

In text messages, the scammer begged: ‘I need to pay the bills now otherwise the amount will be increased,’ and ‘Oh no I can’t wait.’

Known as the ‘friend in need’ con, fraudsters impersonate their victims’ loved ones via the text messaging service WhatsApp

When she later queried with her bank where the payment had gone, she was told it had been paid into an account with Prepaid Financial Services (owned by Australian fintech firm EML Payments).

The firm’s Trustpilot review webpage is littered with complaints that the service is linked to sort codes given out by WhatsApp scammers.

One reads: ‘I was scammed by a WhatsApp message starting ‘hi mum’ as the other reviews. I was at work at the time and unfortunately fell for it, losing £945 into two accounts with this bank’s sort code.’

In September 2019, the firm was fined €1 million by the French banking regulator for lapses in its anti-money laundering controls, including failures to report suspicious card activity to the authorities.

And in May last year, the Central Bank of Ireland launched an investigation into compliance issues at the firm that has now

been rebranded as EML Cardholder Portal. Although the firm itself was not being accused of fraud, as the conduit company, it was accused of not making sufficient checks on where the money was going.

The Central Bank of Ireland has since given EML’s Irish subsidiary the green light to sign up new customers and launch new programmes.’

Fraud reports have rocketed over the past two years, with crooks exploiting the pandemic to prey on vulnerable households.

Victims lost £4 million a day in the first six months of 2021, a 30 pc increase in losses compared to the same period in 2020. Many were targeted by criminals impersonating trusted organisations such as Royal Mail and HMRC.

And this latest trick reveals just how sophisticated fraudsters have become.

Nearly two-thirds of the crooks were impersonating someone’s son, while 33% pretended to be their daughter

Fraud experts at Individual Protection Solutions (IPS) believe victims’ personal details are sold and bought by scammers online.

The firm estimates that 71 per cent of Britons have had details from at least one of their online accounts leaked on the dark web.

Charlie Shakeshaft, founder of IPS, advises: ‘This scam is becoming more and more widespread because it works.

If you feel rushed by a sender, this is a tell-tale sign it is a scam. Take your time, and make sure you hear from the family member or friend directly using another channel. A phone call is ideal as you can recognise their voice.’

WhatsApp is now working with National Trading Standards on its Friends Against Scams campaign to stamp out the con.

Kathryn Harnett, policy manager at WhatsApp, says: ‘If you receive a suspicious message, calling or requiring a voice note is the fastest and simplest way to check someone is who they say they are.’

An EML spokesman says: ‘As a company providing financial services in the UK, we comply with all relevant regulatory requirements, including our obligations regarding customer due diligence and transaction monitoring.

‘As a business, we invest heavily in best-in-class fraud monitoring technology.’

A Financial Conduct Authority spokesman says: ‘If people suspect, or fall victim to, payment fraud, we urge them to report this to their bank and Action Fraud.

We will assess the intelligence we receive and take action if we’re concerned firms are not effectively guarding against financial crime.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.